To put it mildly — the climate crisis is the most existential threat that humanity faces.

Of course, this won’t be news to anyone reading this. The climate crisis has been going on for as long as I can remember — as tragic as it sounds, the phrase has been thrown around for so long that it sounds almost mundane. That being said, the reality is far from mundane. In fact — we’ve been quoted less than ten years to make significant changes before we reach 1.5C in global warming by 2030.

Nevertheless, in the last couple of years, it feels like hope may be flourishing on the horizon. With consumers becoming increasingly environmentally conscious, governments taking real action in implementing climate regulation, and corporates finally publicly acknowledging that treating climate change as charity or CSR isn’t going to be enough to stop the inevitable after all, perhaps there is still time to revert mankind’s biggest mistake.

Investors are wising up to the fact that they have a significant responsibility to play in funding the innovation that could be the key to saving the planet. In recent years, we’ve started to see brilliant individuals, innovative business models and massive technological advancements meet to join forces, building companies that have the potential to crack the biggest challenge in the world’s history.

At Talis, we define the carbon industry as a multi-faceted, multi-stakeholder sector that aims to decarbonise the global economy, while creating a new way of life that doesn’t deploy our planet's resources. As with any emerging sector, we’re excited to invest in the companies and the technology that will be the foundation of this industry: which we’re calling climate infrastructure.

Explaining the urgency of slowing the effects of climate change seems like overkill, but for the purposes of this article — I’m going to do it anyway.

Climate change is the singular greatest threat to life on this planet. Even greater than the COVID-19 pandemic, which in the longer term, will seem like a drop in the ocean in comparison. Despite the fact that we stayed at home (protected the NHS, saved lives, etc.) for the vast majority of 2020, 34 billion tonnes of CO2 were emitted in that year alone. This CO2 will still be in the atmosphere for many generations to come, and will eventually become the problem of our great grandchildren’s generation. This release of CO2 (and other greenhouse gases) is having a disastrous cumulative effect: some of which are visible (like Greenland’s melting ice sheet), some of which are not (like our rising global temperature).

As stated upfront, the threat of climate change is hardly a novelty: there’s documented evidence on the warming effects of carbon dioxides since the 1960s. Since 1988, we’ve had consensus from the scientific community confirming the correlation between human-caused pollution, CO2 and climate change. Avoiding political conjecture as to why, climate action has, historically, been ****framed as CSR or charitable work, rather than a significant enough problem for corporates to prioritise (despite the fact that they’re largely the biggest culprits anyway, but that’s a conversation for another time).

But, times are changing: in the Greta Thunberg era, increased awareness from consumers — paired with the higher profile in the media of undeniable visible effects of climate change — are pushing everybody — governments, corporates, individuals — to take action for the climate and planet earth. Just in time to make a real impact with the looming deadline of 2030.

Consumers are choosing the planet with their money and lifestyle choices. A recent study showed that 72% of Gen Z state they would spend more money on a product if it were sustainably produced, and 87% of millennials say they’d be more loyal to a company that contributes to social and environmental issues. This can be seen in the rise of veganism and plant-based diets — made easier than ever with the commercialisation and availability of alternative proteins and products like milk and cheese — as well as fashion and retail companies with sustainability at their core, which have boomed in recent years. A decade ago, it’d be unimaginable that Oatly, the oat milk brand, could list on NASDAQ, but it’s the reality of the world we live in in 2021.

Corporates and governments are listening too. Nearly 300 companies have made Net Zero pledges (including Talis!) to demonstrate their commitment to the cause, while 120 national governments have made commitments to decarbonise their economy, as well as to work towards climate-friendly regulation, incentives and policies like the European Green Deal.

On top of that, technological advantages in ML, AI, hardware, IoT and cloud have shifted technology costs down and are enabling new business innovations at an unprecedented rate. For example, climate-related data generation is now cheaper than ever because open-source satellite units have driven down the cost of nano-satellites, and advances in ML can compute models with far more variables and data than ever.

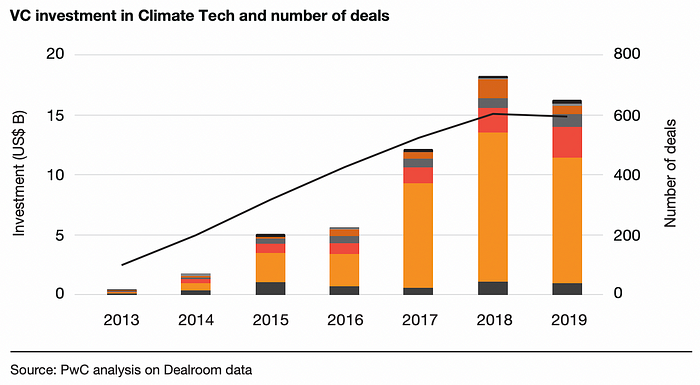

So, as awareness of climate change rises, increasingly more capital is being thrown at companies that broadly fit into this ‘climate tech’ category. Rounds are accelerating in pace — and are dramatically increasing in size. In January 2021 alone, the EV manufacturer Rivan raised $2.65bn, the [California-based ESG commodities marketplace XPansiv raised $40m](https://www.reutersevents.com/sustainability/xpansiv-completes-successful-pre-ipo-capital-raise#:~:text=Xpansiv CBL Holding Group Limited (Xpansiv) has announced,the amount to US%2440M to accommodate investor demand.), and the [food waste app Too Good to Go raised $31.1m](https://thespoon.tech/surplus-food-marketplace-too-good-to-go-raises-31m-to-expand-in-the-u-s/#:~:text=Copenhagen%2C Denmark-based Too Good to Go announced today,to Go’s main mission is fighting food waste.). The size of these rounds signals a breakthrough in a market that has, until recently, not been perceived as commercially viable. Investors have newfound confidence following the cleantech pop of 2006–2011, where investors ploughed $25B into the sector and lost half of it. In fact, a recent report from PWC and Dealroom shows that climate tech investing has grown over 3750% since 2013. To put this into perspective, this is three times the growth that AI saw in the same time frame. Climate tech saw $60bn invested from 2013 to 2019 and $16bn in 2019 alone — in over 1200 climate tech startups. North America is leading the way with $29 billion of investment, while Europe is third after China ($20bn) with $7 billion.

Needless to say, the carbon industry is extremely complex. It affects multiple stakeholders (businesses, individuals, governments and, of course, the planet) all with different motives, as well as different barriers, like carbon sequestering and regulation. The carbon industry deeply affects almost every sector and industry — some more than others, like energy, transport, food, industry and the built environment. At Talis, we define climate infrastructure as the horizontal, cross-sectorial layer of technology that provides the solutions for emission reduction and decarbonisation.

We’ve identified three main subsectors within climate infrastructure that reflect the key objectives behind the majority of the companies we’re seeing in this space: climate analytics, climate intelligence and climate mitigation. Let’s unpack these…